About Elevations Credit Union

Elevations Credit Union is a member-owned, not-for-profit financial institution serving Colorado’s Front Range. Elevations provides a broad portfolio of financial products and services, including checking and savings accounts, mortgage loans, credit cards, auto loans, home equity lines of credit, student loans, business loans, and financial planning. Founded in 1953, Elevations has grown to an institution with more than 130,000 members that manages more than $2 billion in assets and is the No. 1 credit union mortgage lender in Colorado.

1Strategy provided us guidance, training and a high-level of direction, which allowed us to learn as we worked on it.

Wes Saunders, Software Engineer at Elevations Credit Union

The Challenge

Elevations Credit Union’s business performance has fueled their growth. The established, not-for-profit credit union was utilizing on-premises infrastructure, a mixture of onsite and offsite servers. Elevations’ systems were limited and not as scalable as they needed them to be for their services and applications. The company needed a technology infrastructure that is sustainable in a competitive market; they turned to 1Strategy, an Amazon Web Services (AWS) Premier Consulting Partner, for aid and advice in determining that utilizing AWS would provide the capabilities and cost-effective solutions they needed.

Why Amazon Web Services

Based on 1Strategy’s recommendation, Elevations decided to move to a cloud-based infrastructure and chose AWS to leverage their full-service, secure and cost-effective capabilities. With 1Strategy’s expert knowledge of AWS, Elevations knew they would begin their cloud adoption on a solid foundation, which could easily be built upon into the future and would be based on AWS best practices.

“Our migration to AWS was a success all around,” said Wes Saunders, software engineer at Elevations Credit Union. “1Strategy provided us guidance, training and a high-level of direction, which allowed us to learn as we worked on it, building up our AWS knowledge rather than spoon-feeding us or doing the work on their own.”

The Benefits

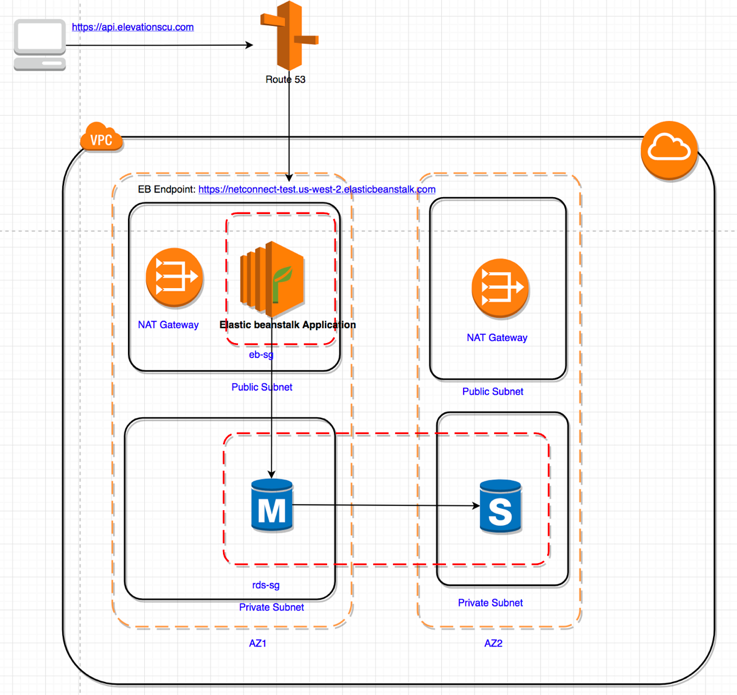

With guidance from 1Strategy, Elevations migrated their production web hosting environment from their physical colocation facility to AWS, with an architecture composed of Amazon Virtual Private Cloud (Amazon VPC), Amazon Relational Database Service (Amazon RDS), Amazon Elastic Compute Cloud (Amazon EC2), Amazon Simple Storage Service (Amazon S3) and AWS Elastic Beanstalk.

AWS Elastic Beanstalk is an easy-to-use service for deploying and provisioning services that automate the process of getting ASP.NET web applications set up on AWS using AWS Toolkit for Visual Studio. With Elastic Beanstalk, the company’s developer was able to simply upload their code, and AWS handled the provisioning of their web servers, app deployments, configuration management, logging, scaling, and others.

1Strategy designed and guided Elevations with the following tasks:

1. Build a VPC network.

- Use Amazon VPC template created by 1Strategy to build a VPC network with public subnets (receiving traffic directly from the internet) and private subnets (not able to receive traffic directly from the internet) in three AWS Availability Zones (AZs).

- Route traffic from the private subnet through the NAT Gateway.

2. Establish an Amazon RDS infrastructure.

- Set up a Microsoft SQL Server Database in Amazon RDS.

- Enable Multi-AZs for the Amazon RDS instance.

- Encrypt at rest by using AWS Key Management Service (AWS KMS) encryption keys.

3. Implement NetConnect applications on Elastic Beanstalk.

- Enable SSL (Secure Sockets Layer).

- Use Amazon Route 53 to redirect traffic to the Elastic Beanstalk endpoint.

4. Deploy Angular static web using Amazon S3 with SSL enabled.

- Host a static website in the Amazon S3 bucket.

- Set up Amazon CloudFront for global distribution and SSL configuration.

- Use Amazon Route 53 to redirect traffic.

Using an AWS serverless architecture instead of their on-premises infrastructure allows Elevations Credit Union to focus on running their applications at scale, without having to worry about managing and configuring their servers. Even more, the company is able to eliminate the operational costs and challenges that occur in maintaining an on-premises environment.

“By migrating to AWS, Elevations Credit Union was able to reduce our operational costs and increase our application capabilities by utilizing serverless solutions. AWS’ ease of management solutions and their scalability made migrating to AWS the correct choice for us,” said Jen Harris, AVP Digital Experience, Elevations Credit Union.

The work described in this engagement was originally completed by 1Strategy, a TEKsystems Global Services company acquired in 2019. As of June 2023, 1Strategy has fully integrated with TEKsystems Global Services to continue to deliver AWS expertise to customers. Learn more about our AWS solutions.

Discover The Power of Real Partnership

Let’s talk about the world of possibilities and how we can partner to make them a reality.